few years ago, while investigating the fortunes of China’s political elite, I traced what looked like a routine “American-owned” investment. On paper, it passed muster. But buried in the filings was a shell company in the British Virgin Islands, ultimately controlled by relatives of a senior Chinese official.

That wasn’t just a curiosity. It was a reminder that corporate filings can conceal power on a global scale—decisions in Washington, Beijing, or Brussels can be shaped by entities that, on the surface, barely exist. The smallest detail—a trust in the Caymans, a holding in Delaware—can redirect billions.

Corporate structures shape how companies operate, how governments regulate, and how fortunes are built—or hidden.

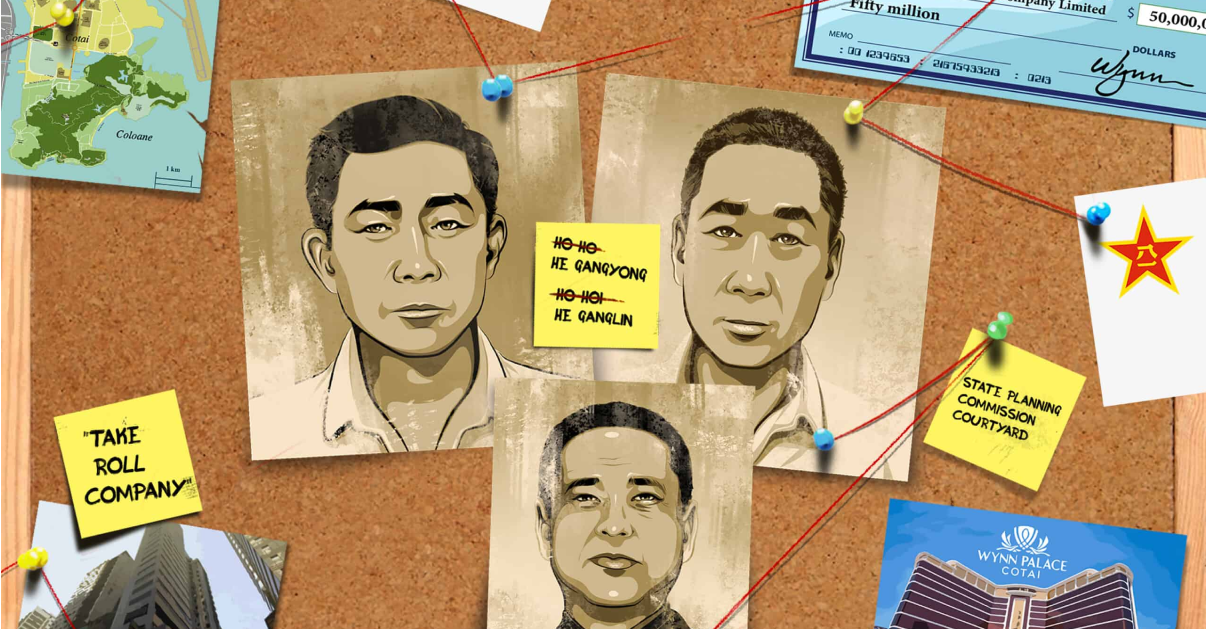

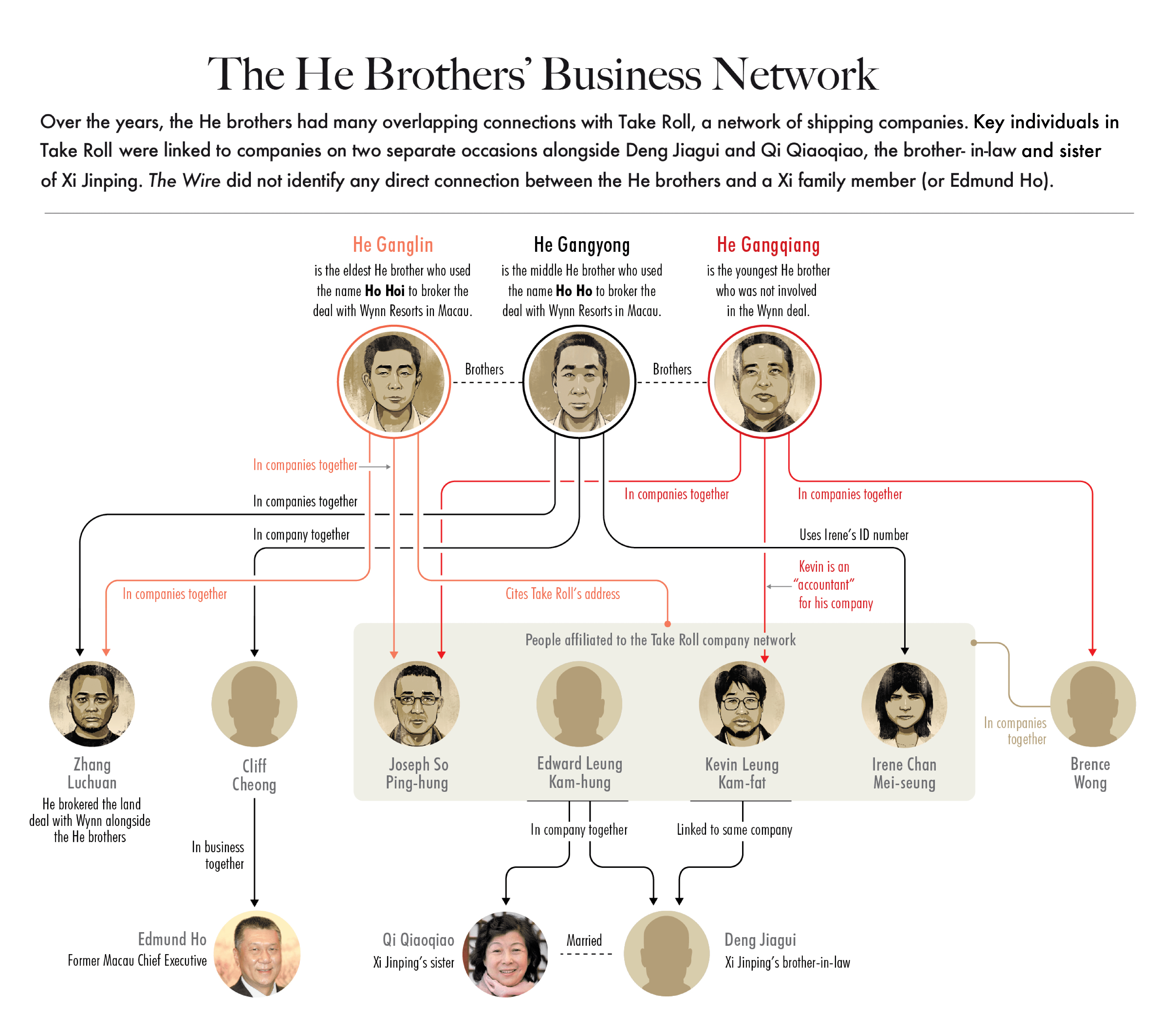

The Panama Papers exposed how shell companies shield corruption. A Planet Money episode offered a window into how easily offshore entities can be set up in a tax haven. And here’s a piece my colleagues at The Wire China published on a secretive land deal in Macau, the gambling capital. These aren’t technical quirks. They’re signals that could be clues to fraud, bribery or tax and sanctions evasion —sometimes, a strategy disguised as opacity.

This isn’t just for specialists or tax collectors. If you care about markets, politics, or accountability, you need to understand how companies are built. You need to understand the architecture of corporate structures. That’s why I co-founded WireScreen, a data analytics firm that seeks to make the world’s most complex business networks more transparent.

On paper, tracing ownership sounds straightforward. In practice, it’s one of the hardest puzzles in global business.

Even seasoned regulators, investors, and journalists can’t easily pierce these veils.

I’ve come to see corporate structures as a kind of business geography. They don’t just chart companies; they reveal how money, law, and influence circulate across borders.

Sometimes a single corporate network sprawls like a spider’s web, with dozens of shell companies radiating outward from one hidden hub. What looks like paperwork becomes a map of power, showing how assets are shielded, risks buried, and influence concealed.

Seen clearly, dry filings turn into living corporate maps. They help uncover fraud, explain strategy, and expose the connections between governments and the firms reshaping our world.

Most reporters ignore this terrain. I’ve come to see it as one of the most powerful tools for decoding the global economy.

The hidden wiring of capitalism doesn’t just shape markets. It shapes geopolitics. And in this era of tariffs and Great Power Competition and supply chain restructuring, seeing it clearly is no longer optional.